A pen and a piece of paper can make a big impact. Kakeibo method, while remaining true to its roots, in the early 20th century in Japan, is a Japanese money saving method of writing down records physically. Kakeibo is more than just a budgeting system – it’s a financial philosophy based on mindful, saving, and deliberate spending. Users answer some financial savings questions and goal settings. Then they track their expenses, put the required in the necessary categories, and review the expenses at the end of the month.

In this post you will find

The culture of saving

Kakeibo method gets its name from the Japanese term meaning, “household financial book”. In short, Kakeibo is a physical cost management journal. Kakeibo is designed to support you in your relationship with money and understand why you’re making each purchase.

Children receive money during ceremonies and are expected to save it until it is required to be spent. And adults don’t take money lightly either. Compared to other countries, Japan has a high cash-heavy economy: credit cards and big-ticket spendings aren’t used as much as they are elsewhere.

Where did the Kakeibo method come from?

Kakeibo is a tradition in Japan. A Japanese journalist Hani Motoko wrote about the method in a women’s magazine during 1904. The Kakeibo accounting system appealed to readers who were in charge of household expenses and management. According to the founders, Kakeibo reflects Japanese cultural beliefs about the importance of saving money. Money plays a crucial role in everyone’s lives.

How the Japanese money saving method works?

The Kakeibo method system starts each month by recording each fixed income and expenses, then sets a savings goal for the month, and also a promise to oneself that will support in reaching the desired goal.

Get a ledger

Kakeibo relies on physical record writing. It requires a journal or even any notebook

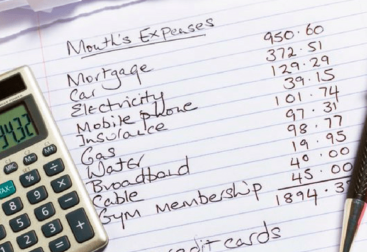

Calculate your monthly income and deduct expenses

All incomes earned weekly should be recorded at the same time a transaction is done, this makes it easier to calculate the total during the end of the month.

Set a savings goal at the end of the month

Ideally, this goal amount should come from the income you have left over after the expenses are deducted. For example, utilities and rent payments.

List your spending categories

Throughout the month 4 pillars have to be considered;

– Survival

Necessary expenses such as food, shelter, and cloths

– Culture

Costs by cultural activities such as fil theaters, reading, and music concerts

– Optional

Things you don’t need but want to get. Such as going to fancy restaurants or going shopping

– Extra

Things that are anticipated like birthday cars and repairs

Categorize everything you buy

Record all your purchases under the appropriate pillars with the purchase amount. The sorting process makes it easier for you to note down your incomes and expenses efficiently.

Answer four reflective questions and the end of the month

The end of the month is met with four questions:

- How much money do you have?

- How much money do you want to save?

- How much money are you spending?

- How can you improve?

Repeat

The pillars and goals are the same every time. The consistency of planning it out is crucial. The Japanese money-saving method will help you manage your expenses and income easily.

Benefits of using the Kakeibo method to save money

The Kakeibo method is meant to reflect two things: a monthly income plan, and a monthly expense plan.

- It simplifies finances by grouping spending into four categories

- Encourages realistically monthly saving goals

- Pays attention to past, present, and future

- Encourages saving small amounts daily rather than big sums

- Celebrates small amounts

Drawbacks of using the Kakeibo method to save money

The biggest challenge of using Kakeibo as a Japanese money saving method is manually keeping track of your weekly expenses. With Kakeibo, you have to record everything and hold yourself accountable. Moreover, carrying your journal around with you everywhere can be a hassle. Using the Kakeibo method can be stressful.

Closing

The ultimate goal is to increase your savings.

Budgeting is no easy walk in the park. Starting a new budgeting plan can be difficult and stressful.

But giving up on it before even trying is not the answer. It’ll take a bit more effort to break out of the circle and get financial freedom. The Japanese money-saving method is efficient and very useful. Just start with a pen and a journal, once you get the hang of it, it’ll be much easier than you think.