Inflation is the word on everyone’s minds. The numbers coming from the CPI index in the United States are scary as inflation stands at a staggering 8.5%. The worst part is that these numbers are reported to be conservative which means that this is the floor value and the true value could very well be much higher.

All this begs the question, how to beat inflation?

The answer is very simple. Increase your saving rate.

You might be wondering, is that it? Then why are all the news channels reporting a gloomy era, why are people running scared?

Get this stat, a staggering 64% of the population lives from salary to salary. They have no fallback money in terms of problems and most don’t even consider a savings account.

The next question you might ask is how does a good savings rate help?

In this post you will find

How to beat inflation with savings?

A very good savings rate

There is a myth that your salary should increase according to the rate of inflation. If the rate of inflation is 10% then the salary should also increase by 10%.

But it doesn’t matter if your salary increases, you are still not better off.

If your monthly salary is more than your rate of spending, then you don’t need your salary to increase at the same rate as inflation.

Let me explain with an example.

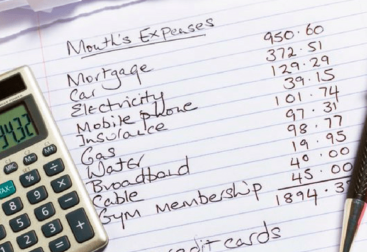

If you earn $100,000 a year and you spend half of it on your living expense which is $50,000.

If inflation affects the world at a rate of 10%. Then the similar life that you have been living so far would cost $55,000.

But to offset this your salary does not need to go up 10% to $110,000. No.

You will only need your salary to go up by 5% to beat the inflation.

If you are not a saver and you spend all your earnings. Then you would need the 10%.

Keep in mind that the companies will not increase your pay easily based on the inflation rate. It will take a considerable amount of time.

In that period where your salary remains the same, you would need to find ways to afford the same lifestyle as before.

This urge to continue living as you did would mean that you need to spend above what you can afford. This means taking on a lot of credit card debt. Slowly this will lead you down a debt spiral that is deadly.

Beat inflation with savings

Having a good saving rate definitely helps. But what helps, even more, is to use those savings to buy income-generating assets.

During inflation, the values of everything go up including gold and stocks. Both of which you can buy right now. Both are under your control.

The best combination is to have a good savings rate, then use savings to buy income-generating assets, those assets return the same or more than the rate of inflation.

You will be in paradise on Earth.

Who does inflation affect the most?

The scary scenario is for the poor people who do not have any savings and who do not own any income-generating assets.

Their expenses will erode their earnings and they won’t have any fallback money.

They suffer the most and during these times, the rich who own good assets increase their wealth by manyfold while the poor are left to suffer.

The dreaded wealth gap increases even further during these times.

Conclusion

I am asking you to go live in a hut and cut off all your spending. No one can make that drastic a change. I am not even asking you to save.

But since so many people are worried about inflation and don’t know how to deal with it.

A simple way that is under our control is to increase your savings rate and the rest will take care of itself.