Middle class people are the ones who drive the economy. They are the ones who consume the most (sales tax) and they are also the ones who do the maximum amount of taxable work (working for a monthly salary). But the reality is that very few people actually make it out of the middle class and move up in terms of wealth. The main reason behind this is very few people understand how money works.

You don’t need to own a big business to gain more wealth. Even with a monthly salary, you can move up the wealth ladder if you understand and implement this one risk free way. That method is:

COMPOUND INTEREST

I am not saying that the lower class and upper class people cannot implement this. The rich people have better investment opportunities and the poor people have a whole set of other problems to take care of before they can even think about compound interest. Middle class people are the ones who are positioned to take advantage of this method and move up the ladder.

Let’s take a deep dive into this subject.

In this post you will find

What is compound interest?

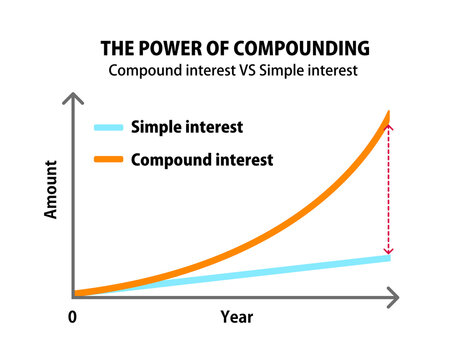

In school, you would have definitely learned simple interest and compound interest in math class. Let’s have a recap. Simple interest is the amount of interest earned on a principal amount based on a pre-determined rate of interest and that interest amount will be the same fixed amount every month. But in compound interest, you earn interest not only on the principal amount but also the interest earned previously. This might sound confusing, so let me explain this better with an example.

Consider, you have invested 10,000 INR in a bank at a rate of 8% simple interest, calculated annually.

| Year | Interest Earned | Total Amount |

| 1 | 800 | 10,800 |

| 2 | 800 | 11,600 |

| 3 | 800 | 12,400 |

| 4 | 800 | 13,200 |

At the end of 4 years, you will have 13,200 in your bank account and you would have earned 3,200 on top of your 10,000 initial investment.

Now let’s look at how the same 10,000 grows when earning the same 8% interest rate compounded annual.

| Year | Interest Earned | Total Amount |

| 1 | 800 | 10,800 |

| 2 | 864 | 11,664 |

| 3 | 933.12 | 12,597.12 |

| 4 | 1,007.77 | 13,604.89 |

Do you see the difference? In simple interest, the interest was earned for the initial 10,000 INR every year, but in the compound interest, the interest was earned on both the initial investment and the earlier interest that was earned. Compound interest would have earned you 404.89 INR more than simple interest in the same period of 4 years.

Both simple interest and compound interest are similar in terms of execution with just one minor change and that one change will move the needle a long way when you look at longer horizons like 30 or 40 years. Let me show you:

| Year | Simple Interest | Compound Interest |

| 1 | 10,800 | 10,800 |

| 10 | 18,000 | 21,589.25 |

| 20 | 26,000 | 46,610 |

| 40 | 42,000 | 2,17,245.21 |

At end of 40 years, you would have had 175,245.21 more if you had chosen compound interest over simple interest. More importantly, your 10,000 INR became 2,17,245.21 after 40 years. You have become a lakhpathi with just your 10,000 INR without even one second of additional work from your end. This is why compound interest is key to risk-free wealth creation.

Now I will explain how you can set up a plan for compound interest so that you can take full advantage of it. The key to all this is just time.

How the middle class people can get started?

Let’s break it down into steps.

Step 1 – Saving:

According to Mastercard’s survey, the average yearly income of an Indian middle-class family is around 3,60,000 INR. This translates to an average of 30,000 INR per month. I know every middle class has a lot of commitments in terms of education loans or automobile loans on top of food and rent expenses. But I am pretty sure that there would some expenses that you could do without every month.

For example, the unwanted expense I cut out was ordering food via delivery apps often, not daily but quite frequently. Once I reduced this to eating out only twice a month, I was able to save close to 3,000 INR (this gives you an idea of how many times I used to eat out). By streamlining one expense, I was able to save so much and I believe that each and every one of us makes a lot of impulse purchases and we could save a lot if all those expenses could be cut out.

By just noting down your expenses and figuring out where you are spending more, you could easily save a decent amount of money. There are actually many tips and tricks by which you could save a lot.

Whatever your salary is, find a way to save a minimum of 10% of it. If it is really difficult then it’s ok, try to save as much as you can. In our example, you could save 3,000 INR on a monthly salary of 30,000 INR.

Step 2 – Finding the bank with the best interest rates

Many people don’t know this, but every bank offers different interest rates. Don’t just stop with the bank you currently hold an account in, call up all the banks or look up online and find out which banks offer the best interest rates. Generally, it is good if the interest rates are above 7.5%, but a lot of scenarios can bring down the interest rates. For example, in terms of a recession or a pandemic (COVID), the interest rates will be very low because the government wants you to spend the money you have in the banks in hopes that it will improve the economy.

Once you have chosen a bank, you need to figure out whether you would be investing in a Fixed Deposit (FD) or a Recurring Deposit (RD). There are a few differences between a Fixed Deposit and a Recurring Deposit based on how they work. But the important thing to keep in mind is that an FD works when you have a decent sum of money upfront, upwards of 75,000 INR or possibly a few lakhs. But in our example, since we have saved only around 3,000 INR the first month, an RD would work better for us.

Step 3 – Structuring a long term plan

The interest rate offered by the bank is only for a limited period of time, generally, it is for 10 years. So you need to deposit the 10% you save every month directly into the recurring deposit. You should aim to have no lapses every month.

Life does not turn out the way you plan every time. There would be a lot of times where you might lose the discipline in your saving and you might have saved less than the goal you set earlier. It’s fine, life happens, don’t be hard on yourself. Just because you lapsed one month, doesn’t mean you continue the same in the coming months. The sooner you get back to plan the better. Don’t punish yourself for these lapses, but rather learn from your mistakes.

Another side to discipline is to never break the deposit at any cost. As we saw earlier, the longer the deposit keeps compounding the larger the returns are for the same. In a span of 40 years, there could be many life changes, many distractions, and certain ones might entice you to break the deposit. But if there is another way then please don’t touch this. This should only be broken only when all other avenues fail.

After the initial 10 years of disciplined saving of 3000 INR every month is done, you would have saved about 3,60,000 INR and you would have earned interest of 1,90,851 INR. So that adds up to 5,50,851 on an 8% return. After these 10 years, you can now choose to start an FD or start another RD and keep adding the 3,000 INR every month to it. Most people I know, invest the accumulated money so far in an FD and use the money they save in the future months to fund other interests and investments.

So open an FD and let’s assume you earn the same 8% interest. In 30 years, your investment would have increased 10 fold to 55,43,024.61 INR. Considering you start working at the age of 21, you would have 50 lakhs by the time you retire and that is a good enough nest egg for your retirement.

Closing Thoughts:

Some may feel that the investment ballooning up to only 10 times the initial investment is very small when compared to other investment options.

But the higher the return, the higher the risk. The above method ensures that you do not lose money at all. The only thing that is out of your control is the interest rate.

Every parameter of the above process is in your control like your expenses, your savings, the kind of deposit, the duration, etc. The only characteristic you need to develop is ‘Patience’.